Vaca Muerta: key factors behind the competitiveness gap with the Permian

A private report indicates that Neuquén’s shale operations trail behind those in the Permian due to lower activity levels, operational inefficiencies, currency restrictions, various regulations, a heavy tax burden and an unstable macroeconomy.

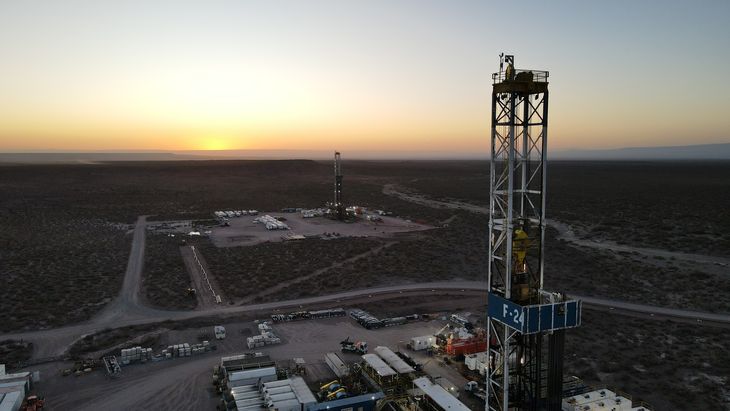

In any business, competitiveness is everything. Over the past decade, Vaca Muerta has made significant strides up a steep learning curve, achieving world-class well productivity. But above ground, there remains a considerable gap compared to the top shale plays in the United States, the Permian being the benchmark for Neuquén’s shale and its primary competitor.

A confidential analysis, compiled by oil operators and accessed by +e, compares the conditions under which Vaca Muerta operates to those in the Permian Basin, the world’s most prolific unconventional oil-producing formation. The biggest difference lies in the level of development and activity volume in the Texan formation, which has been leading the way in the shale business, including the provision of the technology that boosted Neuquén's local oil industry.

Currently, the Permian has over 400 active drilling rigs, compared to 38 in Argentina. The annual investment in the Permian is more than US$40 billion, whereas nearly US$10 billion are expected to be allocated in Neuquén this year, a record figure for the domestic sector.

Operational efficiency shows vast disparities. In the United States, a well can be drilled in just 5 days, while the job takes between 20 and 30 days in Vaca Muerta. Additionally, each pad in the Permian typically has 6 or more wells, compared to 4 per location in the Añelo area.

Equipment Efficiency in the Permian vs. Vaca Muerta

In the completion stage, Vaca Muerta’s productivity is 40% lower, with 6 fractures per day, compared to 10 in the Permian. As might be expected, the latter benefits from a much larger array of specialized services, boasting over 100 active pieces of equipment versus the 10 fracturing set-ups in Neuquén, where roughly 5 companies dominate the market.

U.S. drilling and completion equipment is far more technologically advanced, efficient and cost-effective, as they are gas- or electricity-powered. In Neuquén, progress in this area is slower. This year, Vista electrified a drilling rig and, last year, Eco2Power began testing gas-powered pumps in a fracturing set.

The development and volume of activity of the world’s largest unconventional play become even more evident when production levels are compared. The Permian produces nearly 6.2 million barrels of oil per day, 16 times more than the production in Neuquén, which is currently at its historic peak totaling up to 390,000 barrels per day.

Better Wells in Vaca Muerta

Despite a less favorable scenario and a significantly smaller-scale market, Vaca Muerta hosts several of the world’s most prolific wells. Industry consensus is that Neuquén’s impressive geology allows for wells that are 25-30% more productive than their Permian counterparts. And it is there that the local industry’s competitiveness lies.

To leap into export markets and bring in the necessary capital to develop shale operations—which require continuously drilling, completion, and connecting wells—Vaca Muerta needs to reach closer to U.S. development costs. Currently, an unconventional well in the U.S. has a cost of around US$10-12 million, compared to US$12-14 million in Neuquén.

The Tax Burden

Despite deregulation and a shift towards international pricing driven by the Argentine government, each barrel of Vaca Muerta oil is at a disadvantage with regard to taxes when compared to Permian crude. Argentina applies an 8% export tax, which is not applied in the U.S. Also, imports are subject to a 17.5% surcharge from the Tax for an Inclusive and Solidary Argentina (“PAIS” tax, for its acronym in Spanish, which is withheld on the purchase of foreign currency for saving purposes and certain transactions involving foreign goods and services); this, along with currency controls and a variety of existing exchange rates, deters the foreign investment needed to reach the ambitious goal of producing one million barrels per day.

In addition, operations in the Permian are not charged with bank debit and credit taxes or import duties on equipment and parts, as they are in Argentina. And oil activity in the U.S. is charged with a 21% corporate tax rate, 14 points lower than in Argentina. Other benefits include accelerated depreciation of income tax and indefinite loss carryforwards.

Each barrel sold by a U.S. producer is priced according to the WTI index. In contrast, Vaca Muerta’s crude is priced according to Brent oil, minus export duties, and national governments have often decoupled it from international prices (“criollo barrel”) to control domestic fuel prices and curb inflation rates over the past decade.

Lower Labor Cost in Vaca Muerta

Today, Vaca Muerta’s biggest advantage lies in its labor force, which is four times cheaper than in the U.S. The 118% “megadevaluation” at the outset of Javier Milei’s administration sharply reduced the wage bill in dollars.

On average, a starting salary for an oil worker in the Permian is US$85,000 annually, compared to the annual US$20,000 for a worker in Neuquén, according to the private report obtained by +e.

En esta nota